When it comes to financial exploitation, many scammers are out to target one specific group – our seniors. According to reports and estimations, more than 3.5 million seniors fall victim to fraud each year with an average loss of $35,000 per victim.

Seniors are often targeted because criminals consider them to be less tech savvy, more likely to have physical or mental impairments, and less likely to report scams out of fear of losing financial independence.

When it comes to scams, the best defense is a good offense. Here are some common schemes to be on the lookout for and tips on how to stay protected:

Phone Call Scams

Scammers can set up robocalls with spoofed area codes to appear like they are calling from the victim’s local area or with the caller ID of a government agency. The robocalls will often inform the victim that they owe money or need to take immediate action on an issue.

Online Shopping Scams

Websites created by scammers may appear legitimate, and the domain name may even be a slight modification of a well-known brand. Consumers are often lured into these sites by their low prices and great deals, but the products they advertise are drastically different from what’s received, or they never arrive at all. These fake sites often ask you to pay in ways other than a credit or debit card, leaving you without recourse when the item doesn’t arrive.

Tech Support Scams

Tech support scammers tell victims their computers have issues they can help resolve. They then make money by asking victims to pay for services that aren’t needed. Scammers may also ask for remote access to your computer. While legitimate tech support companies may do this to resolve technical issues, you shouldn’t grant remote access if you haven’t vetted whoever’s on the other end.

Romance Scams

Romance scammers will create fake profiles on dating sites or social media, then reach out to vulnerable people and develop a relationship through chatting or texting. Scammers generally make excuses for why they can’t meet in person. At some point, romance scammers ask their victims for money.

Sweepstakes Scams

In the typical pattern of a sweepstakes fraud, the victim is congratulated on winning a massive amount of money. However, to receive it, they must pay a processing fee or tax. Legitimate lotteries like Mega Millions or Powerball will never charge participants money to receive their prizes.

Other Types of Scams

Other types of scams that are commonly prevalent among elders include utility shutoff threats, fraudsters posing as government officials or friends and relatives, timeshare sale and resale scams, investment scams, and health insurance scams.

Tips on How to Stay Protected

- Always guard your personal information. Don’t offer information to someone who calls you directly, even if they say they are from a reputable company. If uncertain, call the company.

- Don’t act immediately. Scammers may pressure you to pay them quickly and can have a demanding tone. Take a moment to verify who they are and think about what they are asking for.

- Use caution when sending money. Always verify who the receiver is before sending any money. Scammers could tell you to pay in ways where you may not be able to get your money back such as wire transfers, gift cards or other methods of sending money.

- Check your bank accounts regularly for unauthorized charges on credit reports and bank statements.

- Review your social media privacy settings to limit what you share publicly.

- Keep security software up to date.

- Use different passwords for multiple accounts.

- Never click on links or attachments from unknown sources.

- Always remember, if it sounds too good to be true, then it probably is!

If you’ve been contacted by a scammer, it’s always helpful to file a complaint. You can report fraudulent activity to agencies such as the Better Business Bureau, the Federal Trade Commission, and the FBI’s Internet Crime Complaint Center.

To learn more about ways to stay protected, check out the Florida Attorney General’s Cybercrime and Seniors guide.

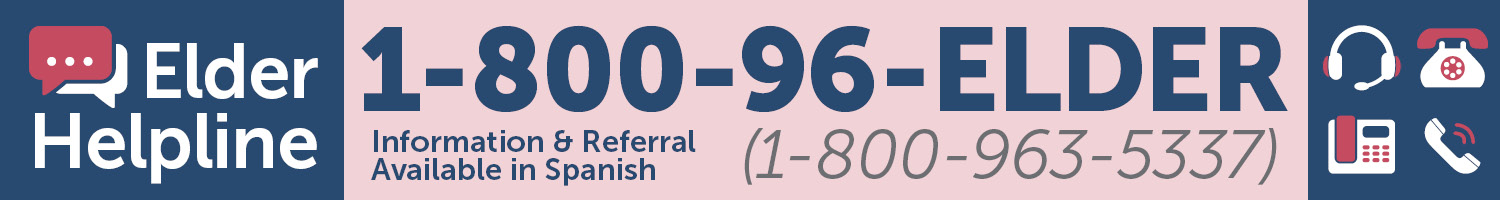

For help identifying potential Medicare scams, visit SHINE or call the Elder Helpline at 1-800-96-ELDER.